Fortune News | Apr 21,2025

May 10 , 2025

By Aminu Nuru

Revered for its principles of interest prohibition, risk-profit sharing, asset backing, and socially responsible investment, the global Sharia-compliant banking has reached a remarkable size of 3.1 trillion dollars, showing an annual growth rate of 10pc. Ethiopia's venture into Islamic banking was launched with high hopes in 2019. Despite the promising start, fully-fledged Islamic banks have yet to meet expectations, writes Aminu Nuru, a financial analyst based in Doha, Qatar.

Global Islamic finance, rooted in the prohibition of interest (riba), risk-profit sharing, asset backing, and socially responsible investment, grew to roughly 3.1 trillion dollars last year, growing by about 10pc annually. Sadly, Ethiopia’s experiment with fully-fledged Islamic (Sharia-compliant) banking has fallen short of its promise.

The National Bank of Ethiopia’s (NBE) directive issued in 2019 to license "interest-free banking (IFB) business” finally opened the door to Sharia-compliant lenders, long anticipated by the country’s sizable Muslim population. Yet, three years after ZamZam Bank became the first such financial institution to open its doors in April 2021, followed by Hijra and Rammis, these newcomers are struggling to match expectations.

The Central Bank's Financial Stability Report for 2024 revealed that conventional commercial banks operating interest-free windows had amassed 73.4 billion dollars in deposits and disbursed 37 billion dollars in financing. Excluding the state-owned Commercial Bank of Ethiopia’s CBE Noor division, the IFB arms of five medium-sized private banks, categorised as such in the 2024 Financial Stability Report, mobilised 73.4 billion Br in deposits and disbursed 37 billion Br in financing as of June 2024. Notably, the IFB arms of Bank of Abyssinia, Cooperative Bank of Oromia, and Dashen Bank each raised more funds individually than all full-fledged Islamic banks combined. The Coop Bank alone mobilised 18.6 billion Br in deposits and provided 14 billion Br in financing, surpassing the aggregate performance of ZamZam, Hijra and Rammis.

Industry insiders attribute this gap to several factors. Conventional banks that launched interest-free windows enjoyed a “first-mover advantage,” drawing customers before full-scale Islamic banks entered the market. New entrants have been unable to lure those customers away. Full-fledged Islamic banks operate under the same regulatory framework as interest-based institutions, a mismatch that inhibited their liquidity management.

The Central Bank’s recent rule allowing short-term interbank lending is interest-based and thus “inaccessible to IFBs,” cutting off a vital funding mechanism.

Behind the scenes, product homogeneity has eroded the appeal of dedicated Islamic banks. Globally, such financial institutions offer a broad suite of instruments from profit-and-loss sharing partnerships, to Sukuk bonds, and trade-financing structures. In Ethiopia, however, Murabaha (cost-plus markup) financing accounts for more than 95pc of all Islamic financing activities. Other products promoted on bank websites “exist only in theory.”

Depositors seeking Sharia-compliant investment vehicles that preserve capital against inflation have little to choose from.

The shortage of skilled talent compounds these limitations. Successful Islamic banks require staff versed in Islamic jurisprudence and modern finance. They lack professionals capable of structuring complex Sharia-compliant offerings, managing risk, and educating customers. Yet, full-fledged IFBs have prioritised religious credentials over technical competence, leaving them short on the product development and marketing expertise needed to compete.

The regulator's strategic dilemma should be the underperformance of Islamic banks. The law issued in 2019 was undoubtedly a landmark move designed to promote financial inclusion, transparency, and entrepreneurship. The regulator now faces pressure to rethink its approach. Several market players argue that bespoke rules are needed to reflect the operational realities of interest-free institutions. Such guidelines might include targeted liquidity facilities or Sharia-compliant interbank instruments.

Full-fledged Islamic banks are considering consolidation, considering the impending NBE's requirements for a minimum capital threshold set to take effect in June 2026. Smaller banks face a clear choice between raising fresh equity in a market that has yet to embrace them or merging with peers to achieve scale. The prospect of a merger could unlock synergies in product development, back-office operations, and brand-building.

For stakeholders committed to ethical finance, the Ethiopian case offers cautionary lessons. Islamic banking should do more than remove interest to provide real alternatives that meet customer needs. Islamic banks have succeeded in markets from the Middle East to Southeast Asia by pairing traditional products with digital innovation, tapping global capital markets for Sukuk issuances.

Ethiopia’s financial ecosystem, still dominated by conventional lenders, now holds the keys to whether the experiment in interest-free banking will flourish. Policymakers, regulators and practitioners should collaborate to craft a vibrant and inclusive model, one that goes beyond Murabaha markups and leverages risk-sharing frameworks to spur entrepreneurship. Without such interventions, full-fledged Islamic banks risk remaining marginal players while conventional banks continue to dominate the interest-free space.

The Ethiopian chapter has only begun for a financial segment valued in the trillions of dollars globally.

PUBLISHED ON

May 10,2025 [ VOL

26 , NO

1306]

Fortune News | Apr 21,2025

Commentaries | Oct 31,2020

Editorial | Nov 26,2022

Fortune News | Jul 18,2020

Radar | Oct 23,2023

Radar | Oct 15,2022

Agenda | Apr 17,2021

Verbatim | May 03,2025

Viewpoints | Jun 25,2022

Fortune News | Oct 03,2020

My Opinion | 129931 Views | Aug 14,2021

My Opinion | 126236 Views | Aug 21,2021

My Opinion | 124253 Views | Sep 10,2021

My Opinion | 122027 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

May 24 , 2025

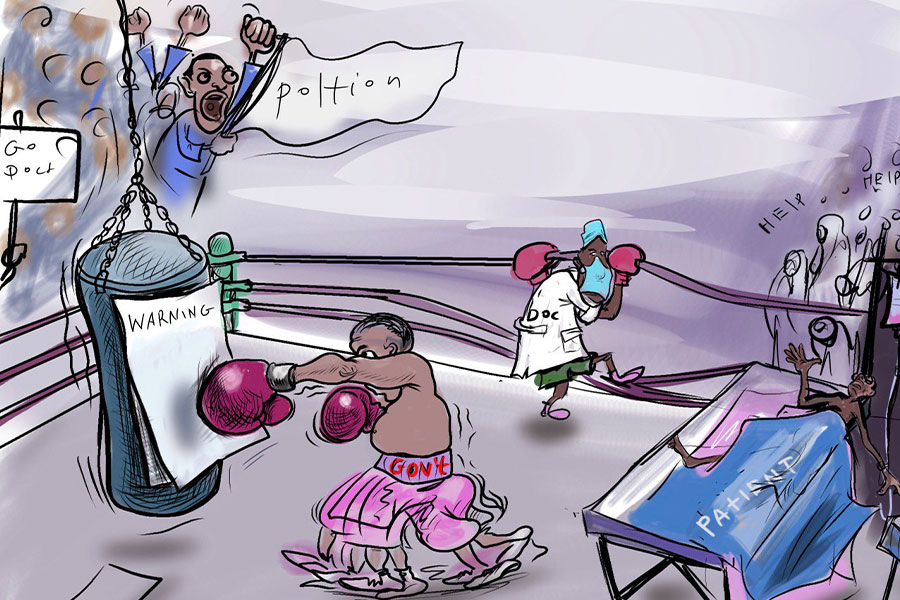

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...

May 3 , 2025

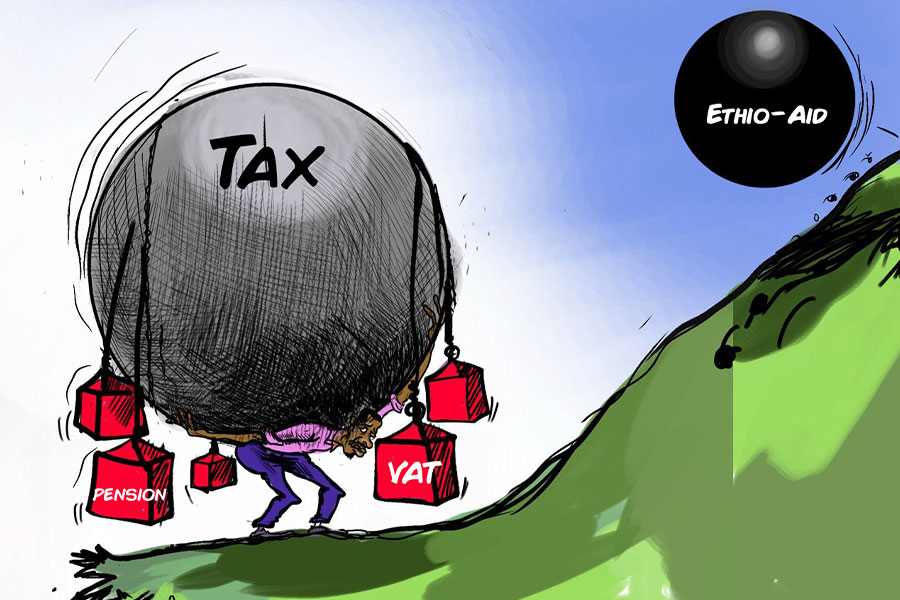

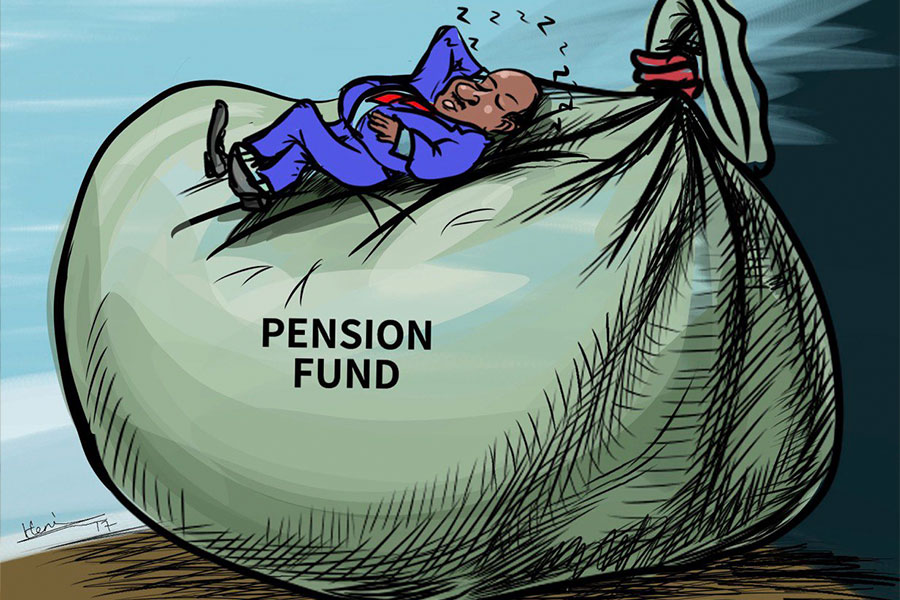

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...

May 24 , 2025

First came the trickle, then the torrent. On a humid night in late March, a low-lying neighbourhood on Addis Abeba's southeastern fringe wat...

May 24 , 2025 . By BEZAWIT HULUAGER

When Moses Akuei received his geology degree from Wolaita Sodo University, the 27-year-old from South Sud...

May 24 , 2025 . By BEZAWIT HULUAGER

The Central Bank is launching a sweeping initiative to overhaul the agricultural finance system, targetin...

Federal legislators are considering a bill that would allow foreign nationals to lease land and own resid...